A recurring question I hear from friends who are new to bitcoin is “What is the bitcoin halving?”.

Bitcoin miners are incentivized to secure the bitcoin network with the coinbase reward. The coinbase reward is an amount of new bitcoin that is created each time a block is added to the bitcoin blockchain. The coinbase reward decreases by a factor of 2 every 210,000 blocks, called the ‘bitcoin halving‘.

In order to better understand the above answer, I will begin the below article by (1) briefly explaining what the coinbase reward is and (2) how the coinbase reward relates to bitcoin mining. I will subsequently explore a variety of relevant questions regarding this topic, such as “How is the coinbase reward calculated?”, “How is the coinbase reward awarded to a bitcoin miner?”, “What is the purpose of the bitcoin halvings?”, “Will bitcoin halvings affect the security of the bitcoin network?”, “Will bitcoin halvings increase transaction fees?”, “Why does the bitcoin halving happen at periodic intervals, instead of the coinbase reward gradually decreasing?”.

What is the coinbase reward and how does the coinbase reward relate to mining?

Bitcoin mining is essential for the security of the bitcoin network.

Bitcoin miners validate transactions and record validated transactions, which they have assembled together in a block, on the bitcoin blockchain. On average, a new block with transactions is added to the bitcoin blockchain every 10 minutes.

In order to earn the right to record a block of transactions on the bitcoin blockchain, miners compete to solve a difficult mathematical problem, called the proof-of-work cryptographic hash algorithm (i.e. SHA256). Finding a solution to the proof-of-work algorithm requires the miners to dedicate large amounts of processing power and spend costly electricity. In order to be compensated for their efforts, miners compete for the chance of winning an amount of newly created bitcoin that comes into existence if and when a new block is recorded on the bitcoin blockchain.

More in particular, the miner who is able to find the solution to the proof-of-work algorithm, thereby earning the right to record a block of transactions on the bitcoin blockchain, will be awarded an amount of newly created bitcoin, called the ‘coinbase reward‘ (also referred to as the ‘block reward‘).

The coinbase reward therefore is an essential mechanism within the bitcoin mining process, which aligns (1) the security of the bitcoin network with (2) the economic interests of the bitcoin miners that are tasked with securing the bitcoin network.

Indeed, due to the decentralized structure of the bitcoin network, a malicious miner trying to include a false transaction in a block will immediately be detected by the other full nodes of the bitcoin network, rendering that corrupted block invalid. The malicious miner will then have lost the chance of being awarded the coinbase reward, whilst having spent large amounts of electricity to mine the invalid block, incurring a sizeable financial loss.

What is the bitcoin halving?

The precise amount of the coinbase reward that is awarded to miners for solving the proof-of-work cryptographic hash algorithm follows a pre-determined scheme.

More in particular, the coinbase reward started off at 50 bitcoin per mined block at the time of bitcoin’s inception. Ever since the first bitcoin block was mined, the coinbase reward has been decreasing by a factor of 2 at periodic intervals of 210,000 blocks that are mined (which is approximately every 4 years). At the time of writing (i.e. July 17, 2019), the coinbase reward stands at 12.5 bitcoin per mined block.

This periodical halving of the coinbase reward is what is known as the ‘bitcoin halving‘ (also referred to as the ‘block reward halving‘).

You can see the estimated date of the next bitcoin halving and a countdown clock here.

The coinbase reward will continue to drop over time by a factor of 2 every 210,000 mined blocks, and will eventually hit 0 at some point in the future (i.e. when the maximum of 64 halvings, as determined in bitcoin’s source code, is exceeded). From that point onwards, miners will be rewarded exclusively with transaction fees.

This means that bitcoin’s supply is strictly limited in amount. Once the coinbase reward hits 0, there will be no more new bitcoin that will be created. Therefore, we know that the maximum amount of bitcoin that will ever come into existence will never be able to exceed the hard cap of 21,000,000 bitcoin (caveat: This holds true, unless bitcoin’s consensus rules would be changed in this regard, which for all practical purposes will never happen as such a change would go against the economic interests of all bitcoin’s stakeholders).

The fact that bitcoin is strictly limited in amount, combined with its high salability across space (i.e. easy to send instantly over the internet or via satellite) and time (i.e. it doesn’t decay over time), is arguably the main reason why one could consider bitcoin to be the single best store of value ever invented by mankind. Indeed, there is simply no other saleable good that exists today that is strictly limited in amount. E.g. gold, which has been a traditional store of value for thousand of years, continues and will continue to be mined until there is no more gold left in the earth’s crust, which is probably never. This is also in stark contrast with the USD money supply (M2), which by some estimates grows by 6 – 7% every single year, roughly doubling the USD money supply every 11 years.

Taking into account that on average a new block is mined every 10 minutes, we are able to predict with a fairly high degree of accuracy how the issuance of all the remaining new bitcoin will play out over time, as depicted in the graph below. It is estimated that the last coinbase reward will be awarded in the year 2140.

How is the coinbase reward calculated?

The coinbase reward is calculated by miners on the basis of the current block height, in accordance with the following formula:

coinbase reward = (50 * 100,000,000 satoshis) / (2 * number of halvings that have occurred)

Let’s say, for illustration purposes, that 585,954 bitcoin blocks have been mined in total, and miners are competing to add the 585,955th block to the bitcoin blockchain. Given that a bitcoin halving occurs every 210,000 blocks that are mined, we know that only 2 halvings have occurred at the block height of 585,954. Therefore, in accordance with the above formula, the coinbase reward for block 585,955 in our example would be 12.5 bitcoin (i.e. 1,250,000,000 satoshis), as calculated below:

coinbase reward = (50 * 100,000,000 satoshis) / (2 * 2) = 1,250,000,000 satoshis

Notwithstanding the above however, it is important to note that the bitcoin source code imposes a maximum of 64 halvings, after which the coinbase reward is reduced to 0 no matter what.

How is the coinbase reward awarded to the bitcoin miner?

For the purpose of bitcoin mining, each mining node begins by constructing a block of transactions and then proceeds to hash the block header of its assembled block (input), using the SHA256 algorithm. If the resulting hash (output) exceeds the difficulty target, the mining node will make an incremental change to part of the block header (i.e. the nonce) and re-apply the SHA256 algorithm, resulting in a different hash (output). This process is repeated (i.e. trial and error method) until a hash (output) is found that is numerically lower than the difficulty target. The miner who is the first to find a hash that is numerically lower than the difficulty target, has the right to record its block of transactions on the bitcoin blockchain and is awarded the coinbase reward and the transaction fees of the transactions that are included in the block.

A miner is able to collect the coinbase reward through the coinbase transaction.

The coinbase transaction is the first transaction that is added by a miner to any new block it is trying to mine.

The coinbase transaction contains two elements:

(a) the coinbase reward, which is a fixed amount of newly created bitcoin (see supra Section ‘What is the coinbase reward?‘); and

(b) the transaction fees, which is the excess amount that remains after all outputs of transactions have been deducted from all inputs of transactions.

The output of the coinbase transaction is payable to the miner’s own bitcoin address.

In other words, the coinbase transaction is the first transaction that is included by a miner in any block, through which the bitcoin miner is able to pay to itself the coinbase reward and the transaction fees for all the transactions that are included in the block.

Even though each miner will individually determine the maximum coinbase reward for the block that it is trying to mine, based on the current block height of the bitcoin blockchain (see supra Section “How is the coinbase reward calculated?“), miners are unable to cheat the bitcoin network by adding a higher coinbase reward than is permitted. If a miner decides to cheat and include a coinbase reward in its block that exceeds the maximum permitted amount, such block will be considered invalid and be rejected by every other full node of the bitcoin network. In other words, the malicious miner will not be rewarded for its corrupted mined block, but incur a substantial financial loss.

Other related questions

What is the purpose of the bitcoin halvings?

The bitcoin halvings ensure that ultimately the total supply of bitcoin remains strictly limited in amount. Once the coinbase reward hits 0 (after 64 halvings), there will be no more new bitcoin that will be created.

This means that the supply of bitcoin cannot be artificially inflated, irrespective of the demand for bitcoin, unlike fiat currencies (e.g. USD or Euro) which are being created out of ‘thin air’ (i.e. out of debt to be more accurate; to understand how the fiat monetary system works in the USA, we highly recommend reading the book The Creature From Jekyll Island by G. Edward Griffin. You can find this highly acclaimed classic on Amazon by clicking here).

The fact that the supply of bitcoin is strictly limited in amount creates in effect a positive feedback loop regarding the price of bitcoin. Given that the total maximum supply of bitcoin is fixed and known today (i.e. it can never exceed a total of 21,000,000), bitcoin’s price is solely dependent on the demand for it. If the demand for bitcoin increases, this automatically means its price has to increase to meet that new demand (and vice versa). When the price of bitcoin increases due to an increase in demand, this increase in price is in turn likely to attract new additional demand, sparking a flywheel effect. This is what legendary bitcoin investor and Austrian economist Trace Mayer describes as the first of seven network effects, namely ‘speculation‘.

In addition to speculation, Trace Mayer identifies the following six network effects that at are simultaneously at play, building up one another, and which are likely to continue to strengthen the bitcoin network and drive up it’s value over time: (2) merchant adoption, (3) consumer adoption, (4) increased security of the network (miners), (5) developer engagement, (6) financialization and finally, (7) the becoming of a world reserve currency.

In this regard, we recommend watching the below video in which Trace Mayer explains in detail said 7 network effects or listen to Trace Mayer’s podcast:

The fact that the supply of bitcoin is strictly limited in amount and cannot be artificially inflated, combined with bitcoin’s high salability across space and time, makes bitcoin a great store of value. Bitcoin’s price can of course fluctuate in accordance with changes in demand for bitcoin, but it cannot be inflated by creating more of it. Bitcoin is therefore deflationary by design.

Taking into account the 7 network effects that are at play, as described above, one could argue that the demand for bitcoin will most likely continue to increase over time, driving up bitcoin’s value accordingly.

Will bitcoin halvings affect the security of the bitcoin network?

As the coinbase reward decreases over time, in accordance with the bitcoin halving schedule, bitcoin miners will increasingly be rewarded by transaction fees. Eventually, when the coinbase reward hits 0, only the transaction fees will remain to compensate the bitcoin miners.

In this regard it is difficult to predict what the long term effects will be of this decrease in coinbase reward for the security of the bitcoin network.

If the bitcoin network continues to grow over time, in terms of number of users and transaction sizes (in kilobytes), as can be expected taking into account the above described 7 network effects, it is likely that transaction fees will also increase accordingly, both in numbers and in value. Although impossible to predict at present times, such increase in number and value of transaction fees could partially or even fully compensate miners for the loss of coinbase reward income in the future.

In any event, we know that the hashing power of the bitcoin network and the mining difficulty will automatically adjust to a level at which it will remain profitable for miners to mine bitcoin, based on the transaction fees as the sole remaining source of mining income. If future mining income based solely on transaction fees would remain at or exceed the present levels of mining income (i.e. including the coinbase reward), the hashing power of the bitcoin network will remain at or exceed the current levels of hashing power. If future mining income based solely on transaction fees would be less than the present levels of mining income (i.e. including the coinbase reward), the hashing power of the bitcoin network will be less compared to the current levels of hashing power.

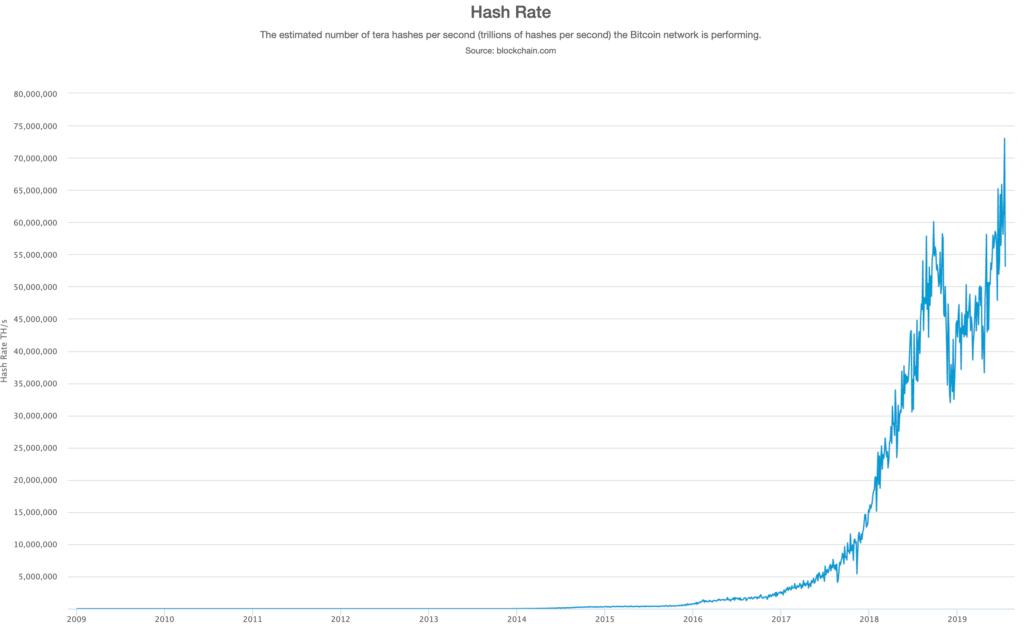

In this regard it is good to keep in mind that the hashing power of the bitcoin network has experienced an exponential growth since bitcoin’s inception in 2009, reaching 70,000,000 TH/s in July 2019, making it by far the most powerful and secure network ever created. Even if bitcoin’s hash rate would drop back down due to the decreasing coinbase reward, bitcoin’s hash rate will likely remain at a level that is extremely secure, far exceeding the most powerful super computers in the world combined.

Will bitcoin halvings increase transaction fees?

There is no relationship between, on the one hand, the amount of the coinbase reward and, on the other hand, the level of transaction fees. Both sources of income for miners are completely separate from each other.

The amount of transaction fees (which is paid voluntarily by bitcoin users to miners) is calculated based on the size (in kilobytes) of a transaction (not the value of the transaction!), and taking into account the network capacity and transaction volume when the transaction is broadcasted to the bitcoin network. Transaction fees will therefore only increase in case of an increase in transaction size and/or the amount of transactions on the bitcoin network continues to increase over time.

Why does the bitcoin halving happen at periodic intervals, instead of the coinbase reward gradually decreasing?

The coinbase reward (also known as the ‘block reward’) is determined in accordance with a specific step function, as explained above (see supra Section “How is the coinbase reward calculated?“), meaning the coinbase reward changes only at specific points in time (i.e. it decreases by a factor of 2 every 210,000 blocks).

It is unknown why Satoshi Nakamoto, the anonymous inventor of bitcoin, chose to code it in that particular way, as opposed to using a function generating a gradual decrease of the coinbase reward over time. In any event, it is highly unlikely that this fundamental feature of the bitcoin protocol will ever be modified, as there is no incentive for miners to seek a change. If anything, one could argue that miners are incentivized not to change the step function, taking into account the fact that up to a bitcoin halving event, bitcoin miners are rewarded with a coinbase reward that is higher than if the coinbase reward would have gradually decreased prior to the bitcoin halving. This gives an early advantage to the present bitcoin miners vis-à-vis future bitcoin miners.

For all practical purposes, from a miner’s perspective, the way the coinbase reward decreases over time (i.e. in accordance with a step function vs. a gradual decrease) is irrelevant. The bitcoin halvings are predictable in both scenarios, and therefore are taken into account in a bitcoin miner’s business model.

Attention! Do you store your cryptocurrencies on an online platform? Please note, in that case you are not the actual owner of your cryptocurrencies!

In particular, you run the risk of losing all your cryptocurrencies, without any recourse, in the event that the online platform or your personal account falls victim to hacking or in the event of an unexpected closure (e.g. insolvency) of the online platform.

Protect yourself against hacking and take real ownership of your cryptocurrencies by storing your cryptocurrencies offline on your very own Trezor hardware wallet. Don’t wait before it’s too late and take immediate action now!

Click on the ‘Buy Now’ button below to buy a Trezor wallet from the official Trezor website.