The maximum number of bitcoins, set at 21 million (rounded), is a key feature of the bitcoin protocol for many of its adherents, myself included. So I wanted to understand how this limit is implemented in the bitcoin source code, and what ensures that said limit of 21 millions bitcoins will never be altered.

The limit of 21 million bitcoins is a consequence of the rate of issuance of new bitcoins through bitcoin mining. Said rate of issuance is written in the bitcoin code and governs the monetary policy of bitcoin, ensuring that the limit of 21 million bitcoins will only be reached around the year 2140.

However, the mere fact that the rate of issuance of new bitcoins is written in the bitcoin source code is in itself not enough. Indeed, it is also necessary that a sufficient number of nodes of the bitcoin network keep enforcing the bitcoin code, including the rules regarding the rate of issuance of newly created bitcoins.

In the past, some participants of the bitcoin network, and in particular bitcoin miners, have tried to circumvent the established rules of the bitcoin protocol, in particular the rules regarding the rate of issuance, by granting themselves more newly created bitcoins than was allowed in accordance with the bitcoin code. In other words, by doing so these bitcoin miners have attempted to circumvent the maximum total issuance of bitcoins set at 21 million (rounded). However, their attempts were unsuccessful, as these attempts were quickly detected and opposed by the rest of the bitcoin network. Let’s explore this in more detail in the article below.

1. Who determines bitcoin’s monetary policy?

The bitcoin network is made up of various types of nodes, each type having a different role within the network. All nodes have a transaction routing functionality. On top of that, a node may also have additional functionalities. The mining nodes of the bitcoin network are nodes which have as a particular functionality the mining of bitcoin. In short, mining nodes assemble transactions that are broadcast to the bitcoin network into transaction blocks (hereinafter “blocks“), and add said transaction blocks to the bitcoin blockchain.

When a miner finds a new block and adds it to the bitcoin blockchain, they are rewarded financially through the ‘block reward’, which is made up of both (1) transaction fees (paid by the people whose transactions are included in the new block) and (2) a set number of newly created bitcoins (i.e. bitcoins that didn’t exist up until that point) which the miner awards to itself. These new units that the miner is authorized to create and award to itself are commonly referred to as ‘block subsidy’ or ‘block reward’.

This block subsidy or block reward is the only way that new bitcoins can and are being created. Therefore, bitcoin’s monetary policy is entirely based on the rules governing the issuance of newly created bitcoins by bitcoin miners when a new bitcoin block is created, as set forth in the bitcoin source code.

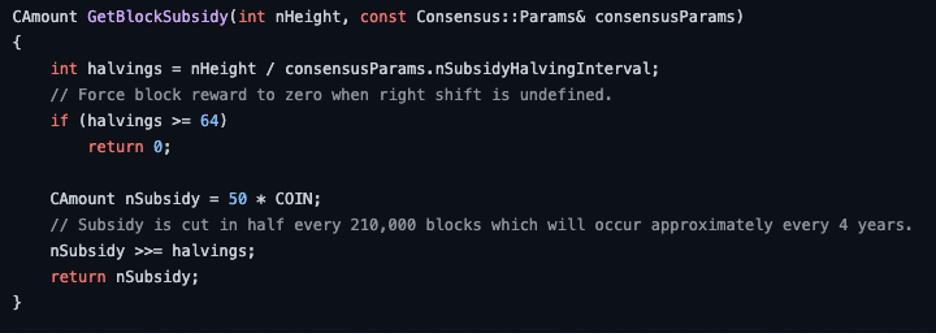

Because the rules in the bitcoin source code provide that the block subsidy decreases over time (i.e. it’s divided by 2), at fixed periodic intervals, to eventually hit zero, we know that according to the rules provided in the bitcoin source code, there can never exist more than 21 million bitcoins (rounded). Indeed, once the block subsidy hits zero, no more bitcoins can be created.

More specifically, the bitcoin source code provides that the block subsidy is halved every 210,000 bitcoin blocks added to the bitcoin blockchain. Initially, a miner could allocate 50 new bitcoins per bitcoin block through the coinbase transaction. Then, after the first 210,000 bitcoin blocks (approximately after 4 years), this reward was halved to only 25 new bitcoins per bitcoin block, etc. Eventually the block subsidy will be zero, more specifically after 64 halvings. It is estimated that this will only take place around the year 2140. I discuss the halving mechanism of the block subsidy in more detail in this article here.

2. Does bitcoin’s source code provide exactly 21 million bitcoins?

If you’ve paid close attention to what I’ve set forth above, you might have noticed that there will in fact never be exactly 21 million bitcoins.

Indeed, if the first 210,000 blocks allowed the creation of 50 new bitcoins per block (i.e. 10,500,000 bitcoins in total, notably half of the total number of bitcoins that will ever be put into circulation), and then cut this number in half per interval of 210,000 bitcoin blocks, and we also know that a bitcoin is only divisible up to 8 decimal places (the smallest unit is 0.00000001 bitcoin, which is also called 1 satoshi), we arrive at the conclusion that the precise amount of the maximum number of bitcoins is 20999999.9769.

But this does not alter the fact that there will never be more than 21 million bitcoins. At least, that’s what we can predict today based on what is set forth in the bitcoin source code regarding the block subsidy.

In this regard, the following 2 questions naturally arise: (1) Can the bitcoin network’s monetary policy be circumvented? and (2) can the bitcoin source code regarding the block subsidy be altered? Let’s take a closer look at these 2 questions below.

3. Who upholds bitcoin’s monetary policy?

Although the rules regarding the block subsidy are included in the bitcoin source code, it is of course essential for the bitcoin network to enforce such rules as to ensure that the bitcoin miners comply with these rules effectively. After all, a miner could try to circumvent these rules by including a higher block subsidy in a bitcoin block than what is allowed according to the bitcoin source code. Miners have already tried this in practice (in vain), such as after the first bitcoin halving, for example, by not halving the block subsidy and thus providing 50 new bitcoins in the coinbase transaction of a bitcoin block instead of the reduced number of 25 new bitcoins.

This is the reason why all the nodes of the bitcoin network, and not just the mining nodes, play a crucial role in the enforcement of the block subsidy and therefore the monetary policy of the bitcoin network. When a miner submits a new bitcoin block to the rest of the bitcoin network, each node independently checks all transactions of this new bitcoin block, and each node makes sure that all transactions of the bitcoin block comply with the rules provided in the bitcoin source code. In particular, each node checks that the number of new bitcoins included by the miner in the coinbase transaction does not exceed the authorized amount. If the block subsidy exceeds the authorized amount, the entire bitcoin block will be rejected and the receiving node will refuse to forward the relevant bitcoin block to other nodes, so that the bitcoin block will not be added to the bitcoin blockchain and the miner will consequently miss out on the block subsidy. The miner who tries to cheat is therefore exposed to the risk of suffering a substantial financial loss as the miner will in principle need (part of) the block subsidy to cover its fixed costs (electricity and CAPEX).

The bitcoin network is an open decentralized network consisting of hundreds of thousands of individual nodes, spread worldwide, each of which individually enforces the rules of the bitcoin network. That is what makes the bitcoin network particularly robust and unique.

4. Is it possible to change bitcoin’s monetary policy?

Now that we know that the monetary policy of the bitcoin network is based on the rules governing the block subsidy as set forth for in the bitcoin source code and I have explained above why miners cannot simply ignore the rules governing the block subsidy, the next logical question that arises if the following: “Can the bitcoin source code regarding the block subsidy be modified?”

While it is in principle possible to change the bitcoin source code, in reality this possibility is not that obvious. This would require first of all a consensus among the bitcoin developer community (i.e. the developers who work on the actual source code), before a proposed change would be effectively implemented in the bitcoin source code. In addition, a change to the bitcoin source code must have the broad support of the bitcoin network, more in particular the bitcoin node, as the nodes will have to install the updated source code. The nodes of the bitcoin network can therefore simply refuse to implement a change to the bitcoin source code if they do not agree with the proposed change. Mining nodes will have to conform to the will of the nodes of the network in this regard, as they are dependent on the nodes of the network for relaying transactions and distributing newly minted bitcoin blocks throughout the bitcoin network. In the event a miner would mine a new block in accordance with a new set of rules which are not supported by the other nodes of the bitcoin network, that block will simply not be propagated throughout the network and would therefore not be added to the bitcoin blockchain and be worthless.

The fixed upper limit of 21 million bitcoins is one of the most essential features of the bitcoin network. In my opinion, it is therefore inconceivable that a majority of the nodes of the bitcoin network would ever accept any change in this regard. Doing so would destroy bitcoin’s most important value proposition.

Even if some nodes would accept a change to the block subsidy rules, there will always be another group of nodes that will continue to enforce the original rules. This would then result in 2 different versions of the bitcoin blockchain, namely (1) the original bitcoin blockchain and (2) an alternative blockchain that is no longer compatible with the original rules. It is then up to the free market to determine which (and the extent to which the) blockchain will be determined as valuable. In other words, one group of nodes, however small or large, will never be able to impose its will on the entire bitcoin network. This is the power of what is called ‘decentralization’; no node(s), individual or group of stakeholders can impose its will on others.

In this regard it is important to note that it has already happened multiple times that a group of stakeholders unilaterally wanted to push through essential changes to the bitcoin source code without there being a wide consensus within the bitcoin network in support of such proposed changes. These attempts have already led to split-offs from the bitcoin blockchain (the so-called ‘hard forks’) on several occasions, such as bitcoin cash and bitcoin gold. If we compare the current market value of these alternative blockchains vis-à-vis bitcoin, one could conclude that the alternative versions have been rather unsuccessful and have had not long term adverse impact on the bitcoin network. This shouldn’t surprise us as the immutability of bitcoin’s consensus rules (including the rules governing the block subsidy) is precisely one of the essential features of the bitcoin network, which explains its spectacular growth in terms of value and users in a world of arbitrary monetary policy under the auspices of central banks. By unilaterally imposing changes to the consensus rules of bitcoin, the pioneers of such alternative versions have gone completely against this central characteristic and ethos of the bitcoin network. In other words, the very existence of these split-off blockchains undermines the credibility and value proposition of these alternative blockchains.

5. How can I ensure at the individual level that bitcoin’s monetary policy is being upheld?

As we saw earlier, it is the nodes of the bitcoin network that ensure that the rules of the bitcoin network are being upheld. You can therefore contribute to the stability and security of the bitcoin network by connecting your own personal node to the bitcoin network.

The hardware requirements for such a node are low enough to be able to run a node on a computer or laptop or on a minicomputer such as a Raspberry Pi. Moreover, nowadays it is also very easy to install a node in terms of software, even for a user who’s technically unskilled. There are some user-friendly solutions available in this regard, such as the web applications Umbrel and Specter.

By means of your own bitcoin node, you will be able to precisely calculate the number of bitcoins that have been put into circulation at any time and thus check for yourself whether the rules regarding the block subsidy are being upheld.

6. Conclusion

As we have seen, the limit of 21 million bitcoins is being enforced thanks to (1) a strong social consensus within the bitcoin community that this limit should be adhered to, and (2) the ongoing monitoring by all the nodes of the bitcoin network ensuring compliance with the consensus rules of the bitcoin network.

Written by author Fanis Michalakis

Attention! Do you store your cryptocurrencies on an online platform? Please note, in that case you are not the actual owner of your cryptocurrencies!

In particular, you run the risk of losing all your cryptocurrencies, without any recourse, in the event that the online platform or your personal account falls victim to hacking or in the event of an unexpected closure (e.g. insolvency) of the online platform.

Protect yourself against hacking and take real ownership of your cryptocurrencies by storing your cryptocurrencies offline on your very own Trezor hardware wallet. Don’t wait before it’s too late and take immediate action now!

Click on the ‘Buy Now’ button below to buy a Trezor wallet from the official Trezor website.