There are numerous reasons for using bitcoin and other decentralized cryptocurrencies. Below we have enumerated 4 reasons, which are in our estimation of major importance.

- Money 2.0

- Monetary sovereignty

- Free speech on the internet

- Lower time preference

Money 2.0

Throughout history a whole range of items have been used as money in order to trade goods and services, such as cattle, cowrie shells, glass beads, gold and silver coins and fiat currency (such as USD and EUR).

Bitcoin is the next evolution in money and represents a giant leap forward in terms of security and efficiency. In a sense bitcoin is the perfect form of money for the Internet because it is entirely virtual, fast, secure, borderless and cheap to use. With the use of bitcoin people and businesses are able to transact directly with each other at opposite ends of the globe, virtually instantaneous, at very low cost, no matter the size of the transaction.

Bitcoin works peer-to-peer, meaning funds are sent directly from individual to individual, without the involvement of any centralized intermediary. This makes bitcoin censorship resistant because the traditional financial institutions and major stakeholders in the financial system (such as credit card companies and payment processors like PayPal) are unable to block any transactions.

In addition, bitcoin restores the monetary sovereignty of individuals. Individuals are able to hold their own private keys, taking away the need for banks to act as a custodian. This means that banks are unable to freeze an individual’s assets, and this makes it substantially more difficult for governments to seize an individual’s assets (they would need to coerce the individual to give up his/her private keys).

Finally, bitcoin is secured by a global decentralized network of tens of thousands of computers, harnessing a truly enormous computational capacity several magnitudes larger than the most powerful super computers in the world. Because of the decentralized structure of the bitcoin network, there is no single point of failure, making it virtually impossible to corrupt the network.

Monetary sovereignty

If someone would ask you “Would you entrust your money to a stranger?”, your answer will most likely be “No.” and you would of course be right to say so. Yet, most people around the world entrust their money to a bank without thinking twice about it. But ask yourself this question: Do banks actually deserve your trust?

During the financial crisis of 2007-2008, the global financial system has shown itself to be vulnerable. Hundreds of banks around the world were faced with the risk of bankruptcy and needed to be rescued through government bailouts. By some estimates central banks around the world (a.o. the Federal Reserve and the ECB) injected more than $9 trillion USD into the global economy in an effort to keep the financial system going (but at a hidden cost to society through inflation). In the wake of the financial crisis many examples can be found of people having lost (part of) their savings, e.g. non-nationals who had entrusted money to the major international Icelandic bank Kaupthing Bank lost their deposits and in 2012-2013 depositors of the Cyprus Popular Bank were forced to undergo a one-time deposit levy for deposits over €100,000 in exchange for a bailout of said bank by the ECB.

Bitcoin has the potential of handing back monetary sovereignty and financial independence to the individual. The decentralized and peer-to-peer nature of bitcoin does away with the need for financial institutions to act as intermediaries in financial transactions. Bitcoin is sent directly from individual to individual over an internet connection.

Individuals are able to hold their own private keys, taking away the need for banks to act as a custodian. This means that banks are unable to freeze an individual’s assets, and this makes it substantially more difficult for governments to seize an individual’s assets (they would need to coerce the individual to give up his/her private keys). Although of lesser importance in a functioning country like the US, there are plenty of countries around the world where such individual protection would be more than welcome. In addition, individuals holding their own private keys are not exposed to counterparty risks, such as the risk of bankruptcy of a bank, which ancient and recent history has shown to be very real when faced with the cyclical crises of traditional global financial system.

Free speech on the internet

Bitcoin is sometimes described as peer-to-peer electronic cash. It is sent directly from individual to individual over an internet connection, without any intervention of a centralized intermediary to clear transactions (such as a financial institution or payment processor). Because bitcoin works peer-to-peer, it is censorship resistant; no financial institution or payment processor is able to stop a transaction from happening. Herein may lie another one of bitcoin’s great promises; free speech for the individual on the internet.

A troublesome trend has been emerging over the past years in the realm of free speech, a cornerstone of western civilization: political activist groups and ‘social justice’ warriors are pressuring social media platforms (such as Youtube, Facebook and Twitter) and major stakeholders in the entertainment industry (such as media and advertisement companies and even credit card companies and payment processors like PayPal) with increasing success to curtail conservative speech.

In 2018 social media platforms have started to ban content creators from their platforms and demonetizing their content under the justification of preventing ‘hatespeech’. A recent example that comes to mind is the banning of famous talk show host Alex Jones in what seems to be a coordinated move by Facebook, Youtube, Spotify and Apple. The danger of such actions and the fundamental problem to this approach is that ‘hatespeech’ is a mostly undefinable notion and its meaning is therefore to a large extent in the eye of the beholder. This makes social media platforms and other mentioned stakeholders vulnerable to external political pressures from all kinds of political activist groups who are interpreting this notion in a way that fits their own political agenda and who are continuously expanding its meaning to everything and anything that does not align with their own political views or to which they take offence.

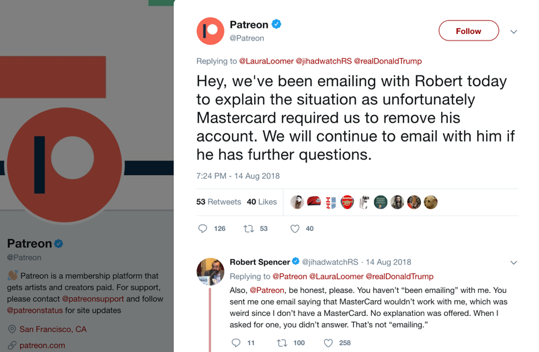

A more recent and even more worrisome example is that social media platform Patreon, providing a service through which people can financially support content creators through donations (inspired by the idea of ‘patronage’), has started banning popular political commentators from its platform in what seems to be an arbitrary purge of conservative speech. Many famous political commentators, including Jordan B. Peterson and Dave Rubin, have since publicly announced that they are leaving the platform out of protest and many are following suit.

In a shocking revelation, Patreon tweeted in response to a complaint from a banned content creator by the name of Robert Spencer that “…unfortunately Mastercard required us to remove his account”. This tweet seems to suggest that major credit card companies like Mastercard, that should have no say whatsoever when it comes to free speech, have started to succumb to the external political pressures to boycott conservative political commentators. Similar worrying signs are appearing from the payment processor PayPal.

The fact that credit card companies and payment processors are beginning to take it upon themselves to monitor content on social media platforms and to pressure platforms to arbitrarily boycott content creators, should be very concerning for anyone valuing free speech, regardless of a person’s own political views.

At the present, a few major credit card companies and payment processors such as PayPal dominate the online payments industry. Because they process most of the online payments, they have the power to strong-arm into submission social media platforms and other major stakeholders who have no choice but to rely on their payment processing services. This concentration of power is slowly but surely revealing itself as undermining one of our most sacred values: free speech.

Bitcoin and other decentralized cryptocurrencies have the potential to break this monopoly. Because no centralized payment processors are involved in a bitcoin transaction, it is for the first time conceivable for people to create alternative social media platforms that are entirely independent from the traditional online payment processors. This will help ensuring free speech on the internet going forward.

Lower time preference

Bitcoin has the potential of lowering the time preference of individuals, to the benefit of society as a whole.

Time preference can be described as the ratio at which individuals value the present compared to the future. Humans apply a discount on the future compared to the present, because the future is inherently uncertain, and immediate consumption is necessary for survival. Further, because more goods can be produced with time and resources, a rational individual will always prefer to have a given quantity of resources in the present than in the future, as he could use these resources to produce more in the future. This means that for an individual to be willing to defer the receipt of a good in the present, that individual would have to be offered a larger quantity of the good in the future. The increase necessary for an individual to be willing to delay his receipt of the good is what determines a person’s time preference (this varies from one individual to another).

The main factor determining an individual’s choices in life is his time preference. In this regard, an individual’s life will be largely determined by the infinite trades made between him and his future self. An individual with a low time preference will be inclined to keep prioritizing his future self until he reaches his desired objectives, while an individual with a high time preference will keep shortchanging his future self to the benefit of the present.

Human beings’ lower time preference is what allows us to think of what is better for the future and act rationally, rather than instinctively and impulsively, lowering the chances of human conflict and self-destructive behavior (e.g. wars). Instead of spending our time and resources on immediate consumption, humans are then able to engage in the production of superior goods that take longer to achieve and create capital goods (as opposed to consumer goods), which will make future production even more sophisticated and technologically advanced, generating more output and ever more superior goods. The more productivity increases in society, the better the quality of life and the more time and resources people will have to spend on non-essential goods and needs, such as cultural, artistic and scientific endeavors. In other words, human beings’ low time preference is a key driver behind human progress and civilization.

Many factors affect an individual’s time preference. Physical security and security of property are among those factors. Individuals who are faced with a high chance of losing their lives or their property being seized or destroyed will more likely discount the future, resulting in a higher time preference. Another important factor is the expected future value of money. In a free society where people are free to choose their money, they will choose the form of money most likely to hold its value over time. The better the money is at holding its value, the more it incentivizes people to delay consumption and accumulate resources, allowing for longer term investments with those accumulated resources (i.e. dedicate resources for future production of superior goods and services). On the other hand, in extremely poor monetary conditions, such as in present day Venezuela where the inflation rate is expected to reach 10 million percent in 2019 (according to the IMF), basic survival becomes the number one priority for the vast majority of people.

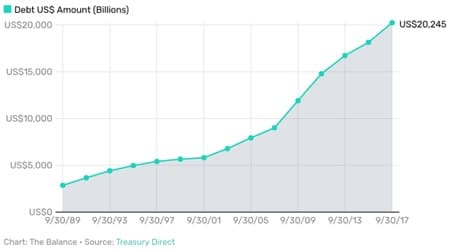

Government issued money is inevitably subject to manipulation by central banks. As such, the cost of capital can be kept artificially low through low or negative interest rates, reducing savings and incentivizing borrowing. The supply of money can be increased ad infinitum, reducing the real purchasing power of money over time through inflation (e.g. the US debt has quadrupled since the year 2000, exceeding 21 trillion USD in 2018).

The manipulation of money can have a profound impact on society as a whole. People are incentivised to spend more and save less, becoming increasingly present-oriented in all their daily decision making and reducing their overall quality of life. Long term investing and rational thinking gets replaced by immediate consumption.

Bitcoin is fixed in supply. No more than 21,000,000 units will ever be created, at a predetermined and continuously slowing rate. Its purchasing power cannot be debased through artificially increasing the money supply. As such, bitcoin acts as a better store of value than government issued money, incentivizing people to save and invest towards the future, as opposed to spending all their money on immediate consumption. Bitcoin has the potential ability to lower the time preference of individuals and society as a whole, increasing human productivity and the quality of life and, by doing so, stimulate human progress.